This company almost needs no introduction. Although I am not really a fan of their products, there is no denying the huge success of Apple: the technology company now has the highest market capitalization in the world at $573 billion, which is more than Microsoft and Google’s valuation combined; the firm is the most admired company in the world; and the Apple brand value is worth $153.3 billion alone. The list is simple endless…

Having only briefly spoken about Apple before, this post will show how the firm’s success is based on simple marketing concepts.

The Product Life Cycle (PLC)

Apple’s iPod is a textbook example of how to manage the PLC from introduction through to decline.

The PLC consists of 4 stages: New Product Development, Introduction, Growth, Maturity, Decline. But it is the introduction and maturity stages where Apple’s marketing ability really shows.

What sets Apple apart from every other technology company is how it utilises its Apple stores to create over-the-top product launch events and generate free publicity. Every time Apple launches a product (not just iPods), all employees make an effort to ensure each customer is congratulate the new owners. It is simple but effective: thousands queue outside – even camping out for several days – just to experience a product launch by Apple. This is entirely unique to Apple – one cannot even imagine consumers showing the same amount of passion for a Microsoft product. The stores are simply great for free PR.

As the maturity stage is the most profitable time of PLC, it is crucial to extend this period to be as long as possible and delay a decline in sales. This is very much true with the iPod. The iPod has already experienced massive growth; now sales are stagnant and predicted to decline. Hence, Apple continuously roll-out extension strategies, updating the iPod with more features, more colours, larger memory, faster processors, a smaller size – anything to keep on getting a short-term sales boost. The cumulative effect of these short-term updates is that, combined, they actually increase long-term sales – see this great infographic on how the evolution of the iPod has grown sales.

Apple also recognise that decline is inevitable – one day they will have to stop selling the iPod. But they are more than prepared for this – the iPhone is almost a direct substitute for the iPod, while the Apple Store is becoming more and more orientated to iPad and iPhone users.

Product Development

Product development is just one of the growth options in Ansoff’s Matrix, but perhaps the most effective for global brands.

As you can see (above), product development involves launching a new product to the firm’s existing customers. If you, like Apple, already have a global presence, in major markets, and understand your customer inside-out, it arguably offers the best trade-off between risk and reward. By launching the iPad, iPhone and operating systems to the same audience Apple builds up integrated customer relationships across multiple platforms and therefore creates brand loyalty. This increases the likelihood of new products being a success. Conversely, Google’s innovations have high failure rates.

The effect on sales of this product range filling strategy has had a cumulative effect on Apple’s sales growth:

The Boston Consulting Group Matrix/ Product Portfolio Management

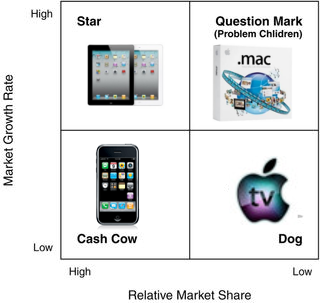

The famous BCG matrix classifies a firm’s product portfolio into four strategic business units (SBU): Stars, Question Marks, Cash Cows and Dogs. Within each SBU, there are again four potential strategies to take: build market share, hold market share, harvest (reduce investment) and divest (phase-out).

Star: This would be the iPad because it has a high share of the rapidly growing tablet market. As the iPad is in its growth phase of the product life-cycle, the product is beginning to lose its first-mover advantage as other manufacturers begin to launch their own tablet devices. Hence, Apple should invest heavily into marketing the iPad in order to grow sales to maintain their share (sales need to grow at the same rate as overall market sales to maintain market share within a growing market). But in the future, when market sales become stable, Apple should harvest the product to turn it into a Cash Cow to fund other SBUs.

Question mark: Despite Apple’s best attempts, PCs with Microsoft operating systems still continue to dominate the PC market. Much of this is down to strong business-to-business marketing and high switching costs for businesses and consumers, alike. Apple could potentially used three strategies for their Mac software:

1) Divest – this could allow Apple to devote more time on their most profitable products, but it is highly unlikely as the Mac is part of the firm’s brand identity.

2) Build – Apple could potentially invest lots and lots of resources to try to turn Macs into a star, however even with Apple’s huge cash pile, it is questionable if it is even possible to beat Microsoft-powered PCs.

3) Hold – this is the most likely strategy. Apple will probably continue to develop new Macs and support existing customers, however investments will be kept at a minimum and be target towards the iPad.

Cash Cow: Apple’s source of steady flows of income are clearly the iPhone and the iPod; both the MP3 and mobile phone market have reached saturation and Apple has a high share of both these markets.

As the iPod is reaching the decline stage of the PLC, Apple is beginning to harvest the product. That is, slowly reducing investment in marketing iPods to increase their profitability; by generating more cash, further investments can be made into question marks or stars.

In the future, Apple will probably only maintain their market share of the iPhone. It is a highly profitable to generate sales from existing customers from upgrades, which can be almost guaranteed after a consumer invests heavily in downloads from the app store.

Dog: Lastly, Apple TV – a device that allows media files in iTunes to be played on a TV – has never really caught-on. By launching a second and third generation, Apple have shown they are committed to building sales. However, unless the overall market for digital media receiver grows, it could be more profitable to divest the product.

Competitive Positioning

Apple have a clearly defined premium strategy: they offer more benefits for a higher price. According the Value Proposition Matrix (above), any of the white squares are competitive strategies. But, I personally believe a ‘more for more’ position is perhaps one of the more effective. This is because it is highly profitable and hard for competitors to copy a premium identity.

Developing a premium, or luxury image, is incredibly hard for both new and existing brands. Hence, it is highly unlikely any of Apple’s competitors will risk undertaking an upward brand stretch and gain a premium status. Moreover, this type of branding allows a premium price tag to be attached to any product – regardless of the quality – with an Apple logo, allowing the firm to make huge gross margins.

This heavily links into Micheal Porter’s famous generic strategies:

A firm’s scope can be either to target a niche market (narrow scope) or a mass market (broad scope); and their strategy can be based on low-cost, or differentiating themselves, with additional benefits, from their competitors.

Apple has been very clever with their choice of strategy, depending on the product. Initially – and for a long time – the firm used a Differentiation Focus strategy while Apple only sold Mac computers. The firm was very niche and was targeting Innovators and Early Adopters:

According Everett Roger’s Diffusion of Innovations theory and Kotler, those who adopt new technological products act as opinion leaders and brand evangelists who spread word-of-mouth promotion about your product. This then attracts the Early Majority, where the bulk of sales comes from.

After Apple used a Differentiation Focus strategy and masses of consumers where becoming more aware of the Apple brand, the firm has moved towards a pure Differentiation strategy. This is seen by the iPod and iPhone that are used by wide range of consumers.

Many firms make a mistake these days of not targeting the Innovators and Early Adopters – they try to immediately win huge sales. Seth Godin (and I) believe this is a poor strategy:

Branding – Corporate Branding / Family Branding

If you have read my previous post on Proctor & Gamble, I am a very strong believer in the power of corporate branding. This is where a single brand image of the firm is used to promote their range of products, rather than developing a brand for each product category. Apple is a great example of this.

Apple’s own brand values – innovation, simplicity, style – have been consistently emphasised across all of their products. These have even been personified by former CEO Steve Jobs’ personality.

This is highly beneficial to the firm because it makes new product launches much more likely to be successful; it seems that Apple could launch an iWhatever and consumers would buy it. Moreover, Apple customers have been so conditioned to Apple brand values that it is naturally assumed a new Apple product will be any of the above brand values.

Further to this, Apple also benefits from something called the ‘Halo Effect’. This is where a customer purchases/likes one product from a firm and is then interested to try out other products the same company has to sell.

As the graph shows, after a big rise in iPod sales in 2003/4, Mac sales also started to pick up more significantly. Many think this is down to the Halo Effect – consumers enjoy their experience so much with their iPods they decided to fully ‘make the switch’ to Mac computers. It has been found by Apple Insider that almost 20% of Mac sales have come from once PC owners who first purchased an iPod. More recently, the same Halo Effect is occurring because of the iPad

To reiterate: it is because Apple has such a good corporate brand that consumers believe if they like one product by the company, they will like all of their products.

Services Marketing

Although I have already blogged about the Genius Bar, it is worth mentioning it again here as it provides a good lesson in services marketing.

Ever since the end of WW2 services marketing has been given growing attention by businessmen and academics. Now, in the 21st Century, offering additional services to a product has become a major source of competitive advantage and brand differentiation. Apple, for example, achieves differentiation from other technology firms through having retail outlets that allow them to provide superior customer service.

The Genius Bar, offers Apple customers face-to-face technical support; a very welcome change to poor after-sales service provided by their competitors. This helps augment their products and support their ‘More for More’ competitive positioning, hence it is an important way to add value to Apple products.

In addition to enhancing their value proposition, it gives Apple an unrivaled chance to practice interactive marketing – engagement between employees and customers. Where as other technology firms often only practice external marketing, Apple can use interactive marketing to enable customers bond with the firm. This is helped by the fact that employees are – or at least perceived to be – brand ambassadors that truly believe in what they are selling.

Marketing Communications

Lastly, there is no point in doing any of the above unless consumers know about it. However, it is hard to say what makes great campaigns. But one thing is sure: they have to be original. There is no real strategy or science behind it, but Apple have managed to get it right on so many occasions:

I hope I have managed to cover the main theories, and used Apple to help explain these, but if I have missed anything out please let me know in the comments below. I also hope I have highlighted how important the Apple stores are to the firm’s success as I feel this is something that is often overlooked by other business writers.

And thank you for reading the whole post!

© Josh Blatchford, author of Manifested Marketing, 29/03/2012